MBA CREF 2020 Recap

The UES team attended MBA CREF in San Diego this week. It’s always a great meeting, chocked full of quality education, networking with clients and making new connections. The MBA does a good job of delivering market trends, forecasts for the year ahead and information that we need to help guide our environmental consulting services.

A few things that stood out this year:

1. Most leaders agree that while we’ve heard a recession is coming, we are still in a good space in terms of growth and liquidity in the market. Lenders are making better credit choices and commercial real estate professionals are focusing on making good deals that can ride out hiccups or shifts should they arise. From listening in on one panel Monday morning, several market leaders believe we are still 18-24 months away from seeing a slow to growth and decreased liquidity. Globe St.Com has a deeper dive into this particular panel and their discussions.

2. Across the board, commercial real estate professionals are in agreement that international affairs, such as concern over the spread of the coronavirus, and the upcoming US election has the potential to impact Q4 of 2020 and the start of 2021. Speakers at MBA stated that their organizations are planning ahead for some volatility in Q4 and working to see how many deals they can close prior to November.

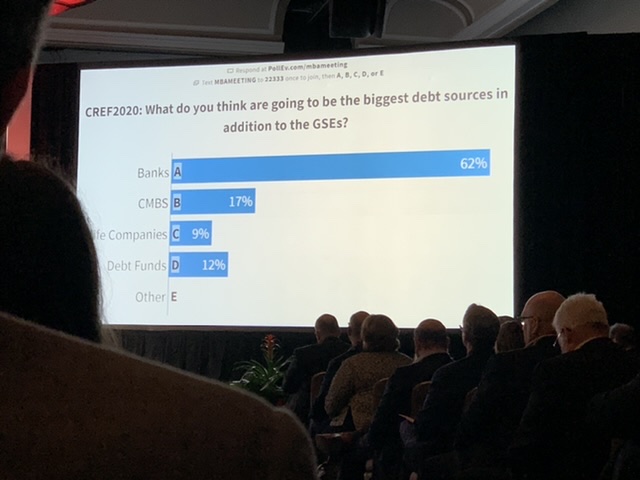

3. Multifamily continues to have it’s moment. And, the market is seeing a wide variety of lending players jumping in. Banks are more involved than in prior years in providing capital. CMBS is making a comeback and the ultra-wealthy are getting involved in the space through investment funds.

Stay tuned to the UES blog for a few more highlights from the last day!

UES Consulting Services, Inc is an environmental and engineering firm specializing in Phase I Environmental Site Assessments, Phase II Subsurface Investigations and Property Condition Assessments for Commercial Real Estate transactions. We frequently research and write on trends, market updates, news and other happenings affecting our clients and partners in the commercial real estate industry