Commercial Real Estate has never been in a better spot but you have to ask the question, what’s coming next?

MBA Vice President of Commercial Real Estate Research Jamie Woodwell expressed his opinion for the sector at the MBA Commercial/Multifamily Servicing & Technology Conference.

“We’re currently in the longest economic expansion ever,” Woodwell said. “There have been a couple negative quarters here and there, but not two in a row, which is the definition of a recession. So there’s been an incredibly long run of economic expansion.“

Woodwell quoted multiple record-setting metrics: Commercial property cap rates are at record lows; MBA accounted a record $574 billion in multifamily and commercial mortgage bankers originations last year; plus loan delinquency rates are at or near record lows.

“So, there are a lot of phenomena going on, putting us in a place we’ve never seen before,” Woodwell said. “Thus, the question becomes what’s next?“

That answer is dependent on your outlook on life.

People on the optimistic spectrum may say they don’t see anything likely to change the current thriving situation. While others may say, “it’s been a great run, so I’m going to get ready for what comes next,” Woodwell said.

So let’s get into the details…

Woodwell used the first quarter’s 3.2% real GDP growth rate to back the current strength of the U.S. economy. Unemployment rate dropped to its lowest point in 50 years and job growth has averaged above 200,000 per month thus far in 2019. “That’s boosted wages, which economists had expected would happen well before now,” said Woodwell.

On the other end, our economies great performance could guide some inflation pressure. “But that has not yet materialized,” Woodwell said. “Some think trade tariffs could start to bring more inflation on.”

With this economic situation, each commercial property type has a unique story to tell…

Multifamily sector: Moving fast in terms of both supply and demand for apartments. The younger generation is filling the shoes of their parents, which supports high demand for multifamily properties. The main surge is in Millennials since they’re beginning to demand apartments and form households; mainly high-quality urban newly developed apartments.

Office sector: Shows a long steady run of positive job growth, but on the flip side, companies are using a smaller space per employee; which leads to the recent fairly stable market. Nevertheless, wage pressure increases while employers struggle to keep their top employees in the middle of an extended strong job market.

“One tool employers could use would be to reverse the recent trend of shrinking office space and increase the room given to employees in an effort to compete for talent,” he said.

Retail sector: Definitely has witnessed the largest changes, mostly due to E-commerce, which has taken over almost 10% of all retail sales and persists to grow 3 basis points each quarter.

“But consumer consumption is strong enough that both E-commerce and brick-and-mortar stores can grow–as long as consumer spending continues, Woodwell said. “But if consumer spending should slip, which will lose more?,” he asked.

Industrial Sector: Has experienced positive evolving changes that have rarely been seen in the past such as new warehouse properties with a second or third story. With manufacturing shipments and E-commerce growing at record highs, the industrial sector continues to thrive–and evolve.

In conclusion…

“When I think about what’s likely to happen, I come back to the idea of a plateau,” Woodwell said. “Coming off a record year of originations, I don’t see much pulling those numbers down, and I also don’t see much pushing those numbers much higher, so we generally see a plateau for originations for the next few years. If we continue to run at this level, that still means growth in mortgage debt outstanding because of maturities, and that means there will likely be more need for servicers like you to service these loans.”

Need help with any Commercial Real Estate transactions?

Even with the pandemic and the grim economic landscape of 2020,…

http://uesconsulting.com/wp-content/uploads/2017/08/UES-Logo-c-750web.jpg

0

0

admin

http://uesconsulting.com/wp-content/uploads/2017/08/UES-Logo-c-750web.jpg

admin2020-11-10 18:29:142020-11-18 18:34:12Medical Office Buildings a Safe Haven Asset During Uncertain Times; Physician Practices Still Struggle

http://uesconsulting.com/wp-content/uploads/2017/08/UES-Logo-c-750web.jpg

0

0

admin

http://uesconsulting.com/wp-content/uploads/2017/08/UES-Logo-c-750web.jpg

admin2020-11-10 18:29:142020-11-18 18:34:12Medical Office Buildings a Safe Haven Asset During Uncertain Times; Physician Practices Still Struggle

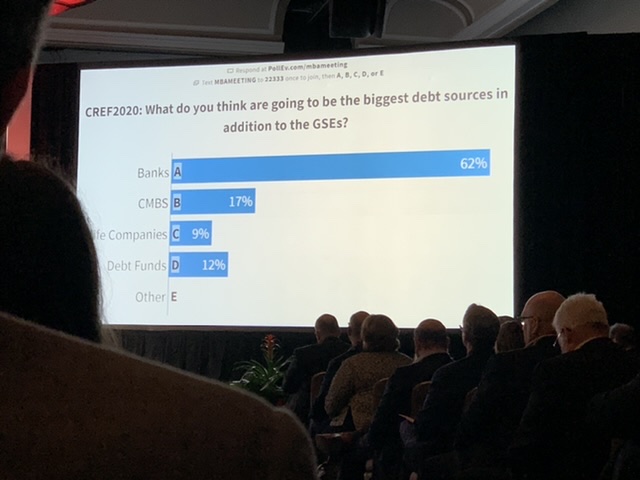

The UES team attended MBA CREF in San Diego this week. It’s…